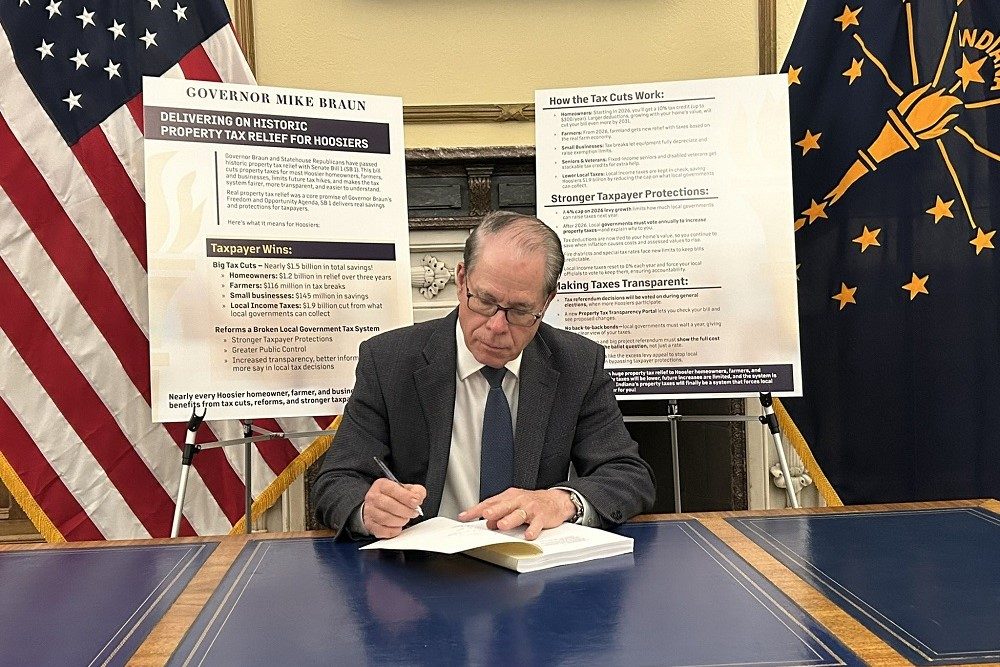

Governor Braun Signs Property Tax Relief Bill

Governor Mike Braun (R-IN) has signed Senate Bill 1, which will provide a reduction in property tax payments for many Hoosier homeowners and farmland owners.

“Today I signed historic tax relief for Hoosiers into law. Nearly every Hoosier, homeowner, farmer, and business owner will benefit from tax cuts, reforms, and stronger taxpayer protections!” said Braun in a post made to his X account.

Braun signed the bill, despite a message from Lt. Governor Micah Beckwith on social media on Saturday saying, “we can’t let this become law” and “the Governor needs to VETO this thing.”

In a conversation with Hoosier Ag Today on Monday, Beckwith said “I’m sorry” to farmland owners for the little relief provided for them in Senate Bill 1, as the focus remains on tax relief for homeowners.

Senate Bill 1 will provide some relief for farmland owners by changing the formula for farmland assessments. In calculating the assessed value for farmland, the capitalization rate increases from 8 percent to 9 percent. The bill would also phase in a one-third deduction of the assessed value of farmland deducted off. The original bill (House Bill 1192) introduced by State Rep. Kendell Culp (R-Rensselaer) sought to raise the capitalization rate to 10 percent.

The main focus of the legislation is a reduction in property tax payments for Indiana homeowners. They will get up to a 10-percent deduction or a $300 maximum cap taken off their property tax bill. The legislation also phases in a larger deduction, which would eliminate the Homestead Exemption, and homeowners would get two-thirds of the value of their home deducted off of their bill.

The bill is estimated to provide $1.4 billion in property tax relief to Hoosier homeowners over the next three years, and $140 million in savings for Indiana’s farmland owners over that same period.

However, the bill now allows Indiana towns and cities with populations of more than 3,500 to impose a brand-new “local income tax” of up to 1.2 percent beginning after Dec. 31, 2027, which Beckwith told Hoosier Ag Today was the main reason why many Hoosiers he had spoken with were unhappy with the legislation.

The Indiana House passed an amended version of Senate Bill 1 by a vote of 65 to 29 on Thursday, April 10. The Indiana Senate then passed the bill by a vote of 27-22 during the early morning hours on Tuesday, April 15.

Today I signed historic tax relief for Hoosiers into law. Nearly every Hoosier, homeowner, farmer, and business owner will benefit from tax cuts, reforms, and stronger taxpayer protections! pic.twitter.com/WWVeD17JyP

— Governor Mike Braun (@GovBraun) April 15, 2025